How Pakistan Import, Refine and Set Fuel Price – A Detailed Guide

This guide covers everything you need to know about fuel, oil, and gas. It includes information on importing, extracting, and supplying petrol to petrol pumps, as well as how the government set petrol price in Pakistan.

Additionally, below are are the latest petrol prices:

Latest Petrol Prices (Last Revision 16th May 2024)

Declassifying OGRA’s Formula to Set Petrol Price in Pakistan

OGRA uses a special formula to set the petrol price in Pakistan. We’re declassifying it exclusively for this article. The OGRA’s formula comprises six components with specific weightage. Here’s the table with an explanation:

Current Petrol Price in Pakistan

The latest petrol price in Pakistan is Rs.273.10/;. We’ve done the above calculation as per the latest figures, and we’ll keep it updated after every petrol price revision. The same calculation is for Hi-speed diesel as well.

Crude Oil Imports of Pakistan

In 2022, Pakistan has imported $5.23B worth of Crude oil, becoming the 29th largest Crude oil importer in the world. Additionally, Crude oil is our second biggest imported product.

Our major crude oil import partners are:

- Saudi Arabia ($2.77B)

- UAE ($2.29B)

- Kuwait ($171M)

Source: Observatory of Economic Complexity (OEC)

Imports of Refined Fuels

Note that our local refineries extract enough fuel to meet a specific percentage of country requirements:

The rest of the fuel is imported in refined form by OMCs (petrol pump companies) and refineries themselves to meet the deficit.

Pakistan’s 5 Big Refining Companies that Process the Crude Oil

Pakistan’s petroleum demand is 19 million tons. While we produce almost half of our petroleum needs through domestic crude oil production, we also import $5.23B worth of Crude oil from other countries as mentioned above.

The crude oil is imported and refined locally by our 5 big refinery companies which are:

- Pak-Arab Refinery Limited (PARCO)

- National Refinery Limited (NRL)

- Pakistan Refinery Limited (PRL)

- Attock Refinery Limited (ARL)

- Cnergyico Pk Limited (CPL)

Their market share is:

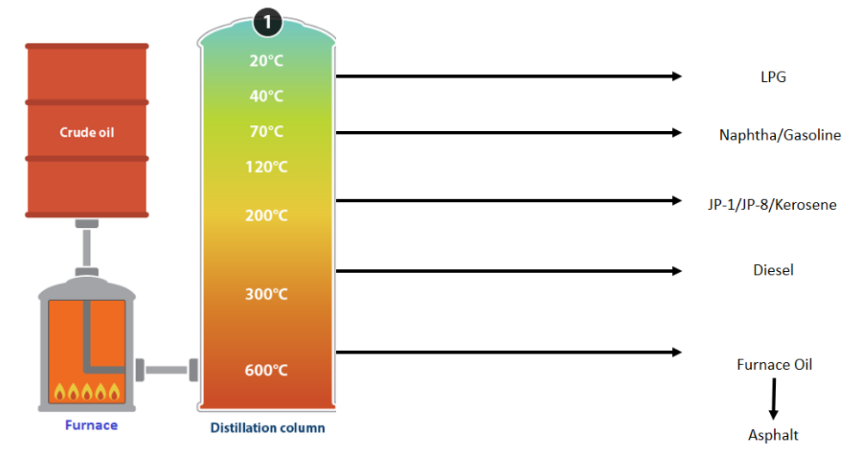

These refineries process the crude oil on a domestic level and extract hydrocarbon fuels and lubricants, including:

- LPG

- Naptha

- Gasoline (Petrol)

- Jet Fuel (JP-1)

- Diesel (Hi-speed Diesel)

- Furnace Oil (FO)

Here’s the diagram for your ease:

All products are produced simultaneously.

All products are produced simultaneously.

Supplying Process From Refinery to OMCs (Petrol Pump Companies)

After processing the crude oil, these refineries sell the processed fuel and lubricants to:

- OMCs, e.g., Shell, PSO, Hascol, GO, Byco, and many more

- Military, e.g., Navy, Pakistan Army, and Pakistan Air Force, so that they can fuel their fighter jets, tanks, military vehicles, and warships.

These OMCs then sell the fuel to B2B and B2C consumers through petrol pumps to customers or directly to factories, industries, and private aviation companies like AirBlue and Serene Air.

OMCs and Their Retail Network

OMCs have a total of 11,848 retail networks (petrol pumps) spread across the country, including, but not limited to, PSO, Shell, Total Parco, Hascol, GO, Euro, and Byco.

Network-wise, PSO has the largest number of retail networks across the country:

TPPL: Total Parco, SPL: Shell Pakistan, APL: Attock

Products-wise sales of each OMC company

(Million Tons, per year average)

MS: Petrol, HOBC: Hi-Octane, HSD: High-Speed Diesel, JP-1: Jet Fuel, FO: Furnace Oil, LDO: Light-Diesel Oil, 100 LL: Low Lead Aviation Fuel

Consumption of Petroleum Products as Per the Industries

(Million tons)

Top Three Pakistani Sectors That Depend on Petroleum

- Transportation 59% dependency

- Power (electricity) 32% dependency

- Industry 8% dependency

Most Consumed Petroleum Products

-

Petrol (9.5 million tons)

-

High-Speed Diesel (9 million tons)

-

Furnace Oil (4.3 million tons)

Flaws in the Refining Sector of Pakistan

Pakistan’s current oil refining capacity is 450,000 barrels per day, equivalent to 20 million tonnes each year. This includes the total capacity of all five local refineries. Here’s the breakdown table of each refinery’s maximum capacity:

The actual capacity utilization is at around 10 million tons. This is due to the lower demand for furnace oil (FO). Explained below:

- Power Plants Shift from FO: Power plants in Pakistan are shifting away from FO and using other fuels like heavy diesel and petrol. This means there’s less need for FO, a product that is naturally created during the Crude oil refining process.

- Refineries Can’t Choose What to Produce: When crude oil is refined, it creates a mix of products like gasoline (MS), diesel (HSD), and Furnace oil (FO). Refineries can’t just produce more gasoline or diesel if there’s no demand for FO—they all come together naturally.

- Lower Overall Production: Because refineries can’t avoid producing FO, they have to lower the total extraction of Crude oil to match the lower demand for FO. This leads to underutilized capacity (refineries not working at their full potential).

Why Only 5 Refineries From 70 Years?

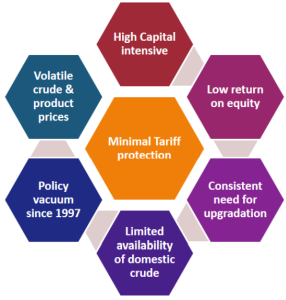

For over 70 years, we have only had 5 oil refineries; why is that? Here’s what OGRA’s “PAKISTAN OIL REFINING POLICY, 2023” says about it:

Source: PAKISTAN OIL REFINING POLICY, 2023 PDF

Source: PAKISTAN OIL REFINING POLICY, 2023 PDF

Let’s break it down into an easy understanding of why we don’t have many investments in the petroleum refinery sector:

- High Capital Intensity: Building a refinery requires a lot of investment, i.e., a large area of land, heavy machinery that is way too expensive, a lot of labor, and skilled engineers that are costly to afford. Importing millions of tons of crude oil is also significantly pricey.

- Volatile Crude & Product Prices: The price of crude oil and refined products fluctuates periodically, making it difficult for refineries to establish a profit structure.

- Minimal Tariff Protection: Pakistan’s refineries do not have a high level of tariff protection, which means that they face competition from imported refined products.

- Policy Vacuum since 1997: The refining sector in Pakistan has not had a clear and consistent policy framework since 1997, which has discouraged investment.

- Limited Availability of Domestic Crude: Pakistan does not produce much crude oil, so refineries have to import most of it.

- Government-instructed pricing: Refineries can’t just sell the fuel at their profit margin, resulting in a significantly lower profit ratio relative to billions of rupees of investment; it just doesn’t make sense for an investor.

Was this detailed guide about import, refine and setting of petrol price in Pakistan helpful for you? Please tell us in the comments section.

Very informative article. Govt. should reduce petroleum levy and sales tax to curb burden on poor mass